Your Personal CFO

At WCG, we believe that wealth management can only be achieved through a process-driven formula focused on protecting and managing all aspects of an affluent family’s wealth. Planning forms the core of the process that places client interests first and considers important tax, risk management, asset management, estate, and philanthropic goals in every decision made and every action taken. If you are the owner of a privately-held business, our process also includes careful analysis to determine the effect business ownership can have on your personal wealth.

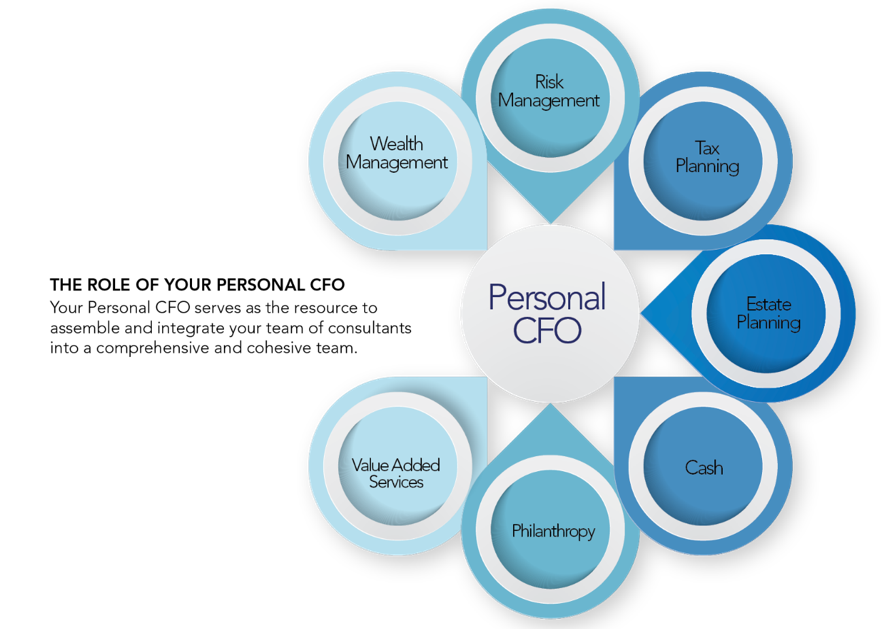

YOUR PERSONAL CFO

Just as a business employs a CFO to coordinate the many aspects of its finances, WCG specializes in developing coordinated strategies and customized, tax-efficient solutions for affluent individuals. As your Personal CFO, we seek to bring the full spectrum of wealth management capabilities and resources necessary to address your complex financial needs. We collaborate with your other professional advisors to ensure seamless coordination of your financial strategies in a manner that places your interests first in these and other areas:

SPECIALIZED SERVICES

- Financial Planning • Insurance Planning • Business Success Planning

- Retirement Income Planning • Estate & Legacy Planning • Employee Benefits

- Investment Management • Philanthropic/Charitable Giving • Corporate Retirement Plans

- Education Planning • Trust Services

- Tax Strategies • Executive Compensation & Benefits

Investment advice offered through WCG Wealth Advisors, a Registered Investment Advisor. WCG Wealth Advisors, The Wealth Consulting Group and FIDES Wealth Strategies Group are separate entities.

FIDES Wealth Strategies Group, and WCG Wealth Advisors, LLC do not offer tax or legal advice.